Sierra Chart Platform Features

Sierra Chart

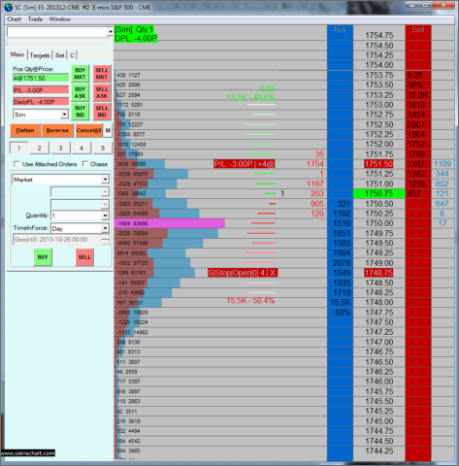

Advanced trading functionality includes:

- DOM and chart-based order execution and position management

- Create personalized indicators and trading systems

- 400+ fully customizable indicators and technical studies library

Denali Data Feed

- Powerful reliability of Denali Data Feed

- Streaming futures market quotes and alerts

- Historical, intraday, and real-time data

- Depth of market data on stocks, commodities, indexes, mutual funds, currencies, and more!

Sierra TT Order Routing

Enjoy secure order routing powered by TT’s FIX Market Feed, which ensures secure low latency routing and connectivity to global futures exchanges

State of the Art Futures Brokerage

The power of the Sierra Futures Trading Platform is bolstered by a world-class brokerage experience. All trades cleared through Advantage Futures.

Double Nickel Pricing

Without being nickeled and dimed

Sierra order routing included!

+ exchange & regulatory fees

TRADERS BENEFIT FROM:

- EUREX AVAILABLE!

- Sierra Chart Trading Platform

- Denali Data Feed

- FREE Sierra Chart Order Routing

- $250 minimum account opening

- E-mini $3.70/RT